Explore IMMA

IMMA provides an extraordinary space where contemporary life and contemporary art connect, challenge and inspire one another. Use the filters below to find curated content for you or jump to our calendar to see what’s on.

EXPLORE EVENTS AND EXHIBITIONS

- Content Suitable For:

Explore Collection

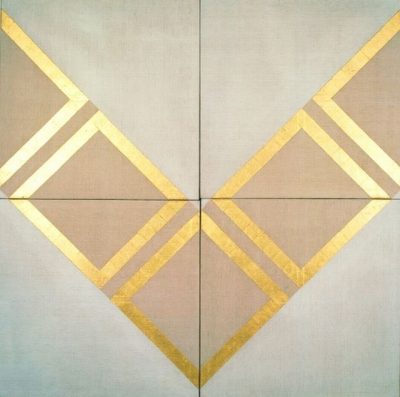

IMMA is home to the National Collection of modern and contemporary art, with over 3,500 artworks by Irish and International artists. Our aim is to share and to develop the Collection for now and for the future. Search and explore the collection in your own time using the new collections archive.

Finger Box Ay-O 1964

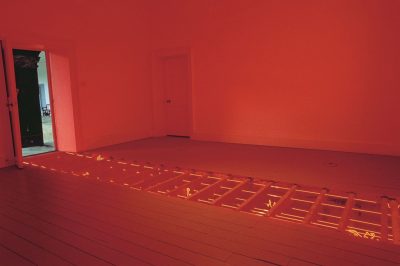

Hate/Love Isaac Julien 2006

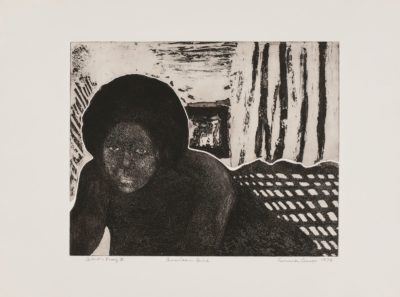

American Girl Emma Amos 1974

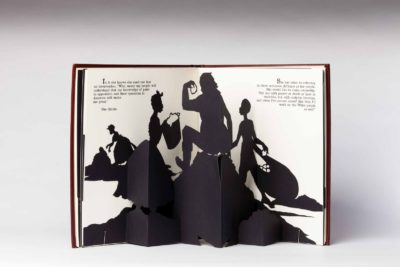

Freedom, A Fable by Kara Elizabeth Walker – A Curios Interpretation of the Wit of a Negress in Troubled Times With Illustration Kara Walker 1997

Tree Niamh McCann 2010

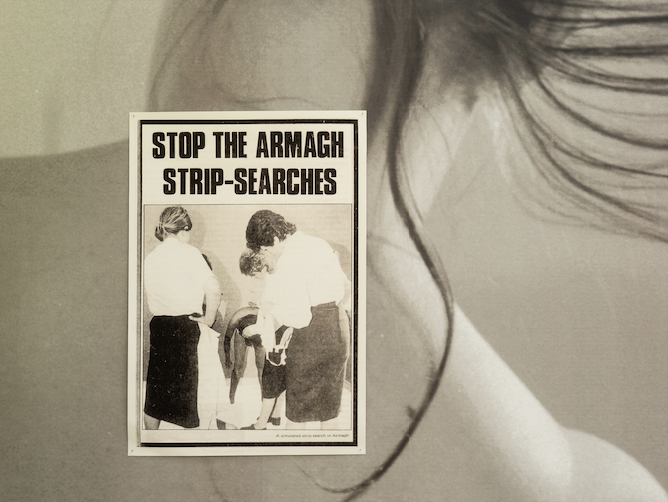

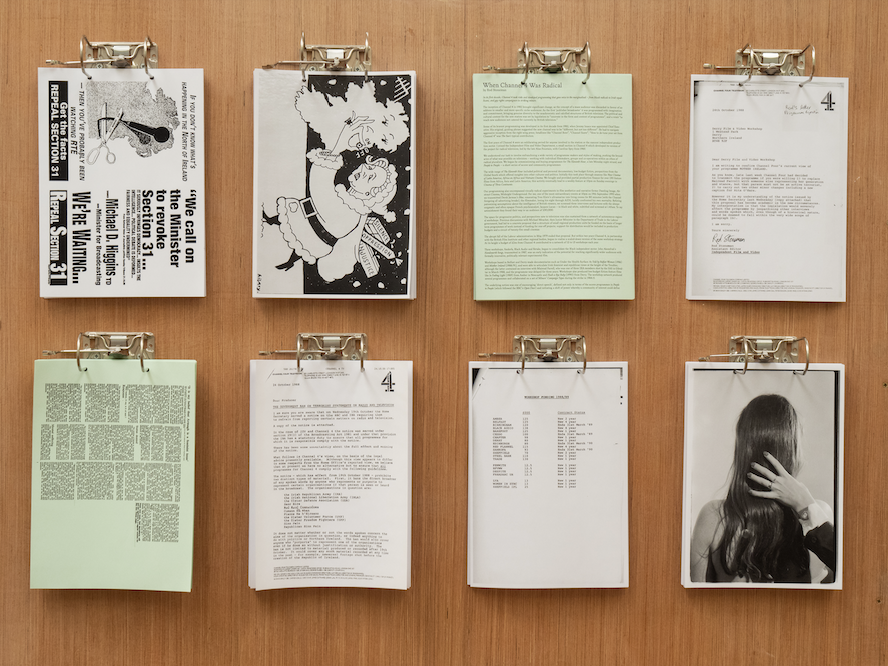

No More Mairéad McClean 2013

The Party Mark O'Kelly 2010

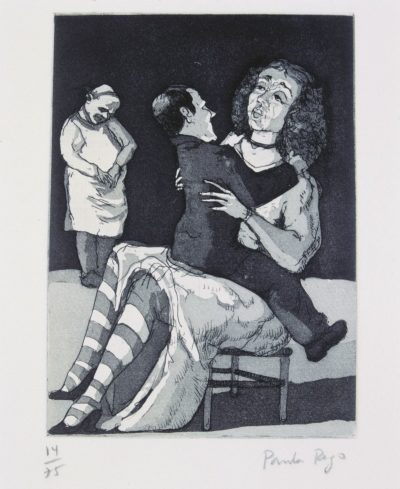

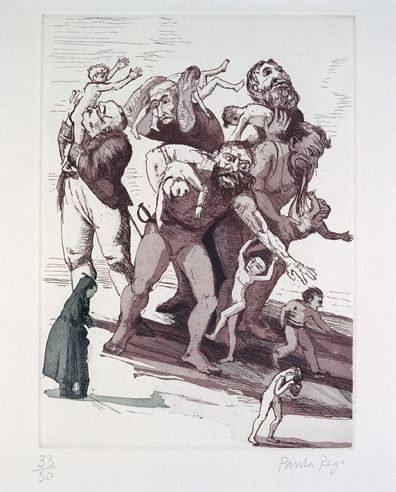

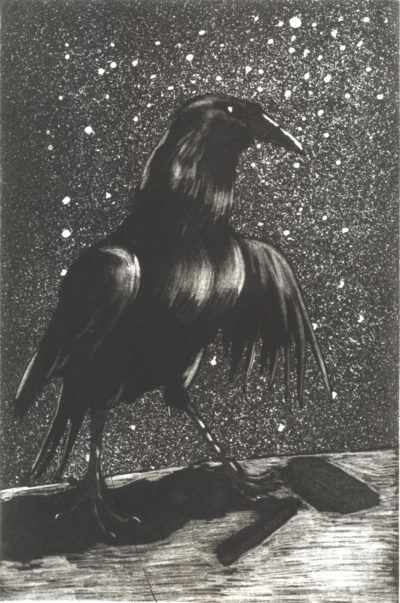

The Night Crow Paula Rego 1992

Take IMMA home

We have an extensive selection of exclusive art books, limited art editions, exhibition posters and other exhibition items in our IMMA Shop, and a great selection of cards, gifts and design products too. All purchases from the shop help to fund our busy programme.

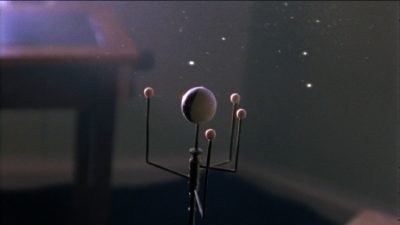

Xenogenesis €35.00 The exhibition is accompanied by a major new publication, The Otolith Group: Xenogenesis, an extensive and comprehensive polyphonic exploration of the work of The Otolith Group. View Product

The Mary and Alan Hobart Collection €19.95 This beautifully produced publication accompanies the major touring exhibition, Paula Rego, Obedience and Defiance. The selection of works brings together paintings, drawings, and prints spanning the artist’s career from the 1960s to the present. It focuses on works that addresses the moral challenges of humanity, particularly in the face of violence, gender discrimination and political tyranny. View Product

Lucian Freud and Jack B. Yeats, 2019 €20.00 With this catalogue, we are very pleased to present new research and responses by scholars, curators and artists, to both Lucian Freud and Jack B Yeats. Edited by Christina Kennedy and Nathan O'Donnell with texts from David Dawson, William Feaver, James Finch, Róisín Kennedy, Hilary Pyle and Eithne Jordan. View Product

Membership

The IMMA MEMBERS programme provides a space to connect through culture and creativity. Join our inclusive community, composed of those seeking to experience the Museum in new ways. If you enjoy our grounds with your dog, are already familiar with our galleries, or are just looking for more creative inspiration in their lives, IMMA MEMBERS is for you. Learn more on how to join here.

Log

Log